Using Company Information Data for Research, Reform, and Accountability

This analysis of the Global Data Barometer company information thematic cluster was compiled by Alanna Markle, Senior Manager, Policy and Research at Open Ownership.

Historically, ownership and control of companies was straightforward: a person who owned a quarter of the shares owned a quarter of the company, was entitled to a quarter of its profits, and had a quarter of the decision-making votes. This information was largely available to governments, investors and the public as it was viewed as necessary for companies to function well, protect the rights of shareholders, and for the rights and benefits associated with company incorporation to be held to account.

However, as economies and legal systems have globalized and become more interconnected and complex, there have been changes in how companies, and other legal vehicles such as trusts, partnerships or investment funds, can be owned, controlled, and benefitted from. This has created avenues for individuals to obscure their ownership and misuse corporate vehicles for illicit or unethical purposes, including facilitating corruption, money laundering, and tax avoidance or evasion. The gathering and sharing of information about companies by governments is a critical countermeasure to this opacity.

Transparency of company information is fundamental for the public good: to ensure that companies and other legal vehicles play a productive and ethical role in society, and are not misused. The Global Data Barometer Company Information Module supports these aims by considering the existence and availability of structured, open information on company basics such as company name and legal form, status, and a reliable identifier. It also looks at the governance and availability of more complicated ownership and control information, including on shareholders and on beneficial owners (BO) – the natural persons who ultimately own, control, and benefit from legal vehicles, whether through shareholding or other means.

Having comprehensive company information makes it possible for people to understand BO networks, or the relationships between individuals, legal vehicles, and assets. Understanding these networks is key both for preventing the misuse of legal vehicles and also for more aspirational policy agendas. For example, tax authorities can use company information to help ensure the right tax is paid, and intervene when there is a risk of that not happening. Meanwhile, academic research using company information is supporting the G20 policy agenda on taxing the super rich, which aims to slow the growth of wealth inequality globally.

Unpacking the State of Beneficial Ownership Data

This second edition of the GDB puts an emphasis on the responsibilities that governments have to collect, store, and share information about companies and their ownership by maintaining accessible registers. The focus on government publication of information is reflected in the results. For example, Mexico was considered to have some BO information available in the first edition, but this partial information was only compiled thanks to civil society efforts and relied on stock exchange filings and other third party sources.

While methodological changes between the first and second editions can make direct comparisons misleading, the poorer results for availability in the second edition highlight that more needs to be done to systematically make comprehensive BO information accessible to a wider range of users in Mexico and most other jurisdictions. In fact, only two countries, Nigeria and Ecuador, scored above a 0 in the second edition on availability of BO information.

On the other hand, the policy and technical conversations around access to BO information have also evolved since the publication of the first edition of the GDB. Namely, a 2022 ruling by the Court of Justice of the European Union (EU) led to the suspension of indiscriminate public access to BO registers for legal entities in many EU member states, and has significantly influenced the discussions, proposals, and negotiations about access rules in the EU and globally. The EU’s sixth anti-money laundering directive, finalised in early 2024, includes provisions for access to BO information based on demonstrating legitimate interest as well as taking more steps to make the data standardised and interoperable.

While EU countries are not captured in the data, the ruling has had an impact beyond EU borders, and has highlighted the global need to balance information availability with the right to privacy. Subsequent research by Open Ownership on the use of BO information has also made it clear that there are many dimensions to usability for policy impact. These are captured in both the governance and availability aspects of the second edition, for example laws should have clear and comprehensive definitions and requirements to verify the information to a high level of assurance. It will be interesting to see how the apparent trade off between access and how easily and flexibly the information can be used will be assessed by the GDB as the space evolves over time.

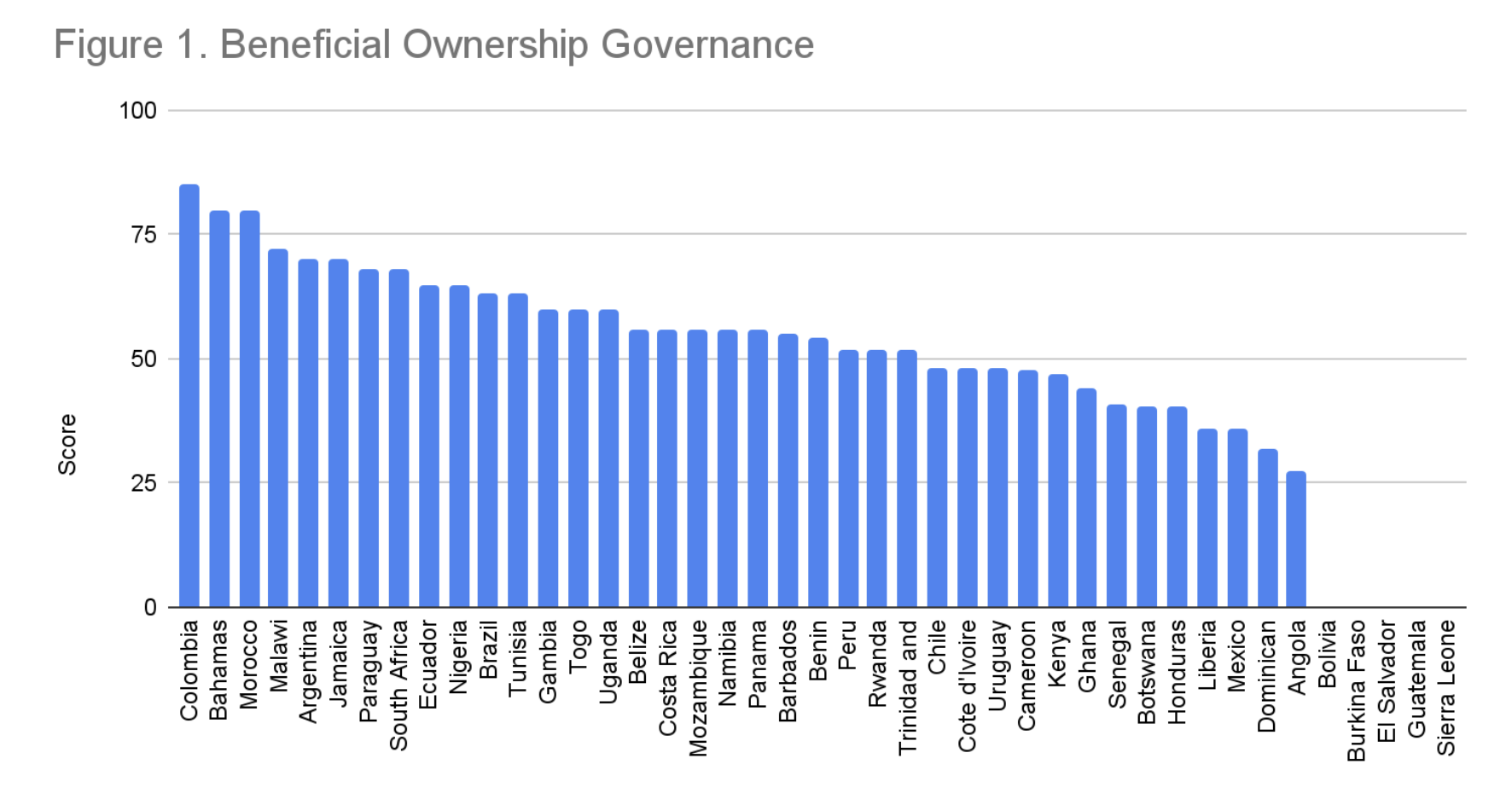

Governance of BO information is evaluated much more favourably than availability in the second edition, which reflects the continued global momentum for BOT reforms (Figure 1). The top scores demonstrate the diversity of countries that have developed high quality legal frameworks across Latin America and Africa. While further progress is needed, this mirrors Open Ownership’s experience providing technical assistance in these regions.

The evolution in our understanding of BO data usability has also pushed Open Ownership to think harder about the overlaps and complementarities between BO and company information. BO information partly overlaps and should be considered along with other types of information, including information from shareholder, trust, and asset registers, to see how these can be brought together to better understand networks of relationships between individuals, entities, and assets. A comprehensive approach can reduce redundancy and the compliance burden while improving understanding and quality. For this reason, the second edition of the GDB collects more information on the availability of shareholder information.

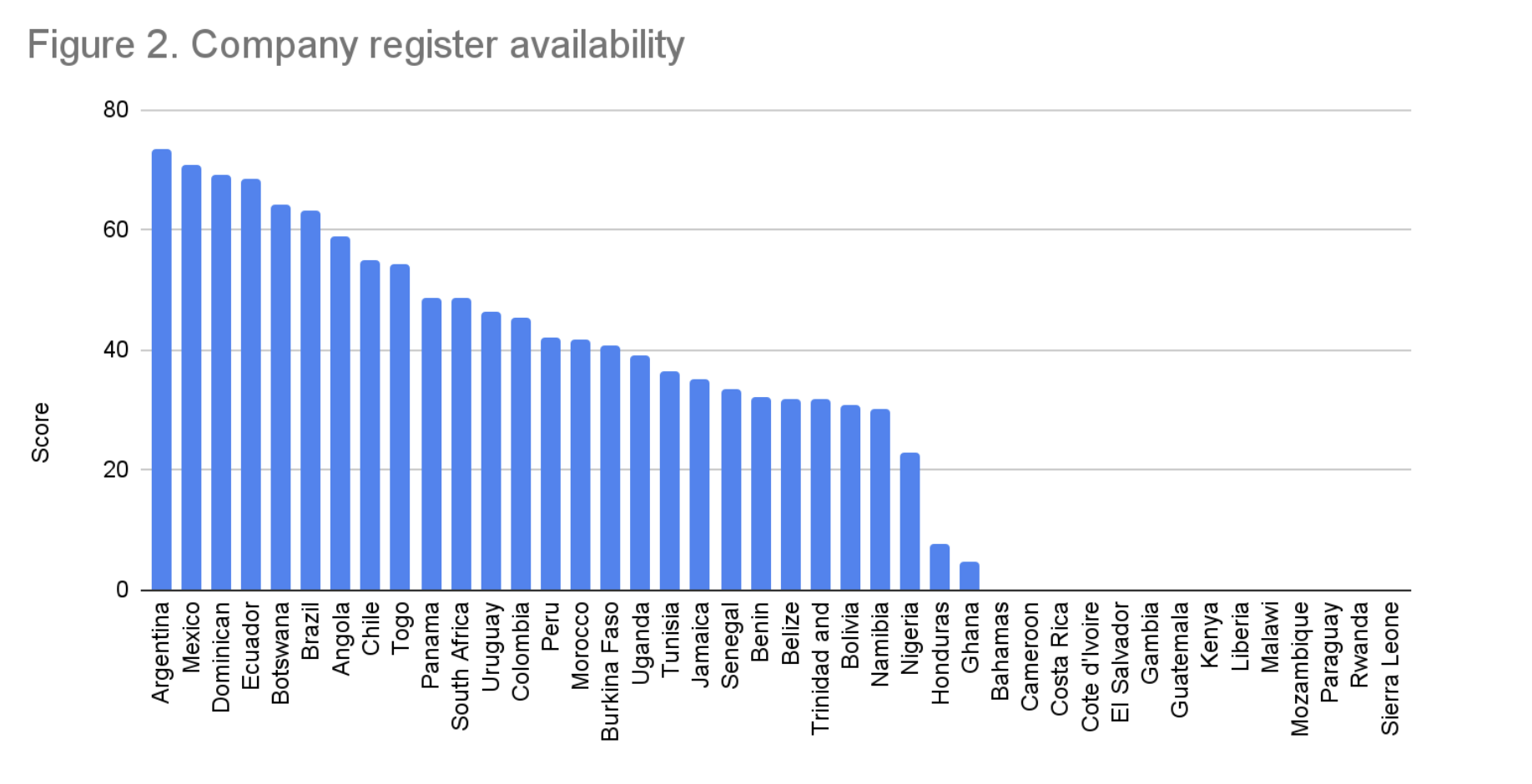

The level of availability of company register information far exceeds BO register information in general, especially when it comes to basic details about legal entities (Figure 2). However, the second edition data reveals that few countries made information on shareholders available, with notable exceptions including Botswana, Ecuador having a good amount of shareholder information and Jamaica, Togo, and Colombia having partial information.

A Call to Action: Join the Effort to Improve Beneficial Ownership Data Transparency

Transparency in the business environment is not a given. Researchers can support the continued health of the company information ecosystem through work that demonstrates, documents, and measures the impact of governments, businesses, and citizens having access to accurate, complete, and high-quality information on companies and the people who own, control, or benefit from them. This type of research is an essential contribution to keeping the policy space open for these reforms to be sustained and improved.The GDB dataset is an invaluable resource in these efforts. Already, it is being used in academic research, for example to explore patterns and motives for beneficial ownership reform. Over the coming years, Open Ownership and partners will be working to expand the evidence base for the impact of having transparency in BO networks, and how different sources of information – including information about BO of legal vehicles and shareholders – can most effectively contribute to having a better understanding of these networks. We invite you to get in touch if you are interested in joining this effort.